Auto Insurance

Best Car Insurance Companies For 2025

- Updated March 7, 2025

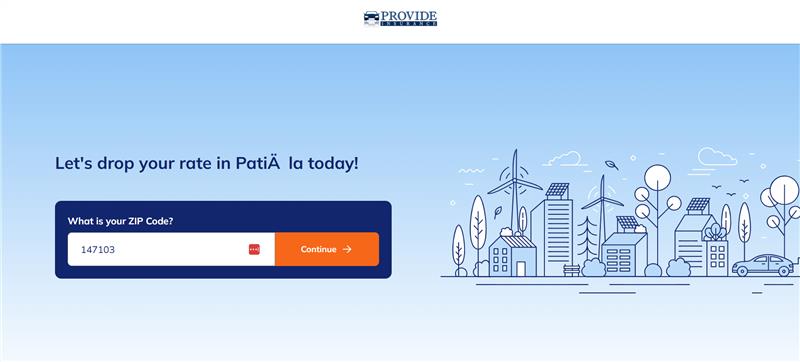

Compare car insurance rates in your area!

See if you qualify for a lower rate in less than 2 minutes

- FAST, EASY & FREE

Choosing the best auto insurance company in 2025 means balancing affordability, coverage, and customer service. With evolving policies, tech-driven perks, and changing rates, finding the right fit is key. This guide explores top insurers, their benefits, and what to consider for the best protection.

With insurers offering AI-driven claims, usage-based discounts, and expanded coverage options, drivers have more choices than ever. The key is to evaluate financial strength, customer satisfaction, and policy flexibility to ensure reliable protection.

Beyond affordability, choosing the best insurer depends on coverage quality and service. Some providers excel in handling claims quickly, while others offer perks like accident forgiveness or roadside assistance.

Top 5 Auto Insurance Companies

- ProvideAuto Comprehensive coverage with custom options.

- AutoQuoteGuide Competitive rates with usage-based discounts.

- EasyAutoPolicy Strong customer service and bundling deals.

- Insure.com Personalized policies with local agents.

- Insuremenow Affordable rates for high-risk drivers.

Provide Auto Insurance

✅ Nationwide Providers

✅ Easy Comparison Tool

Ranked #1

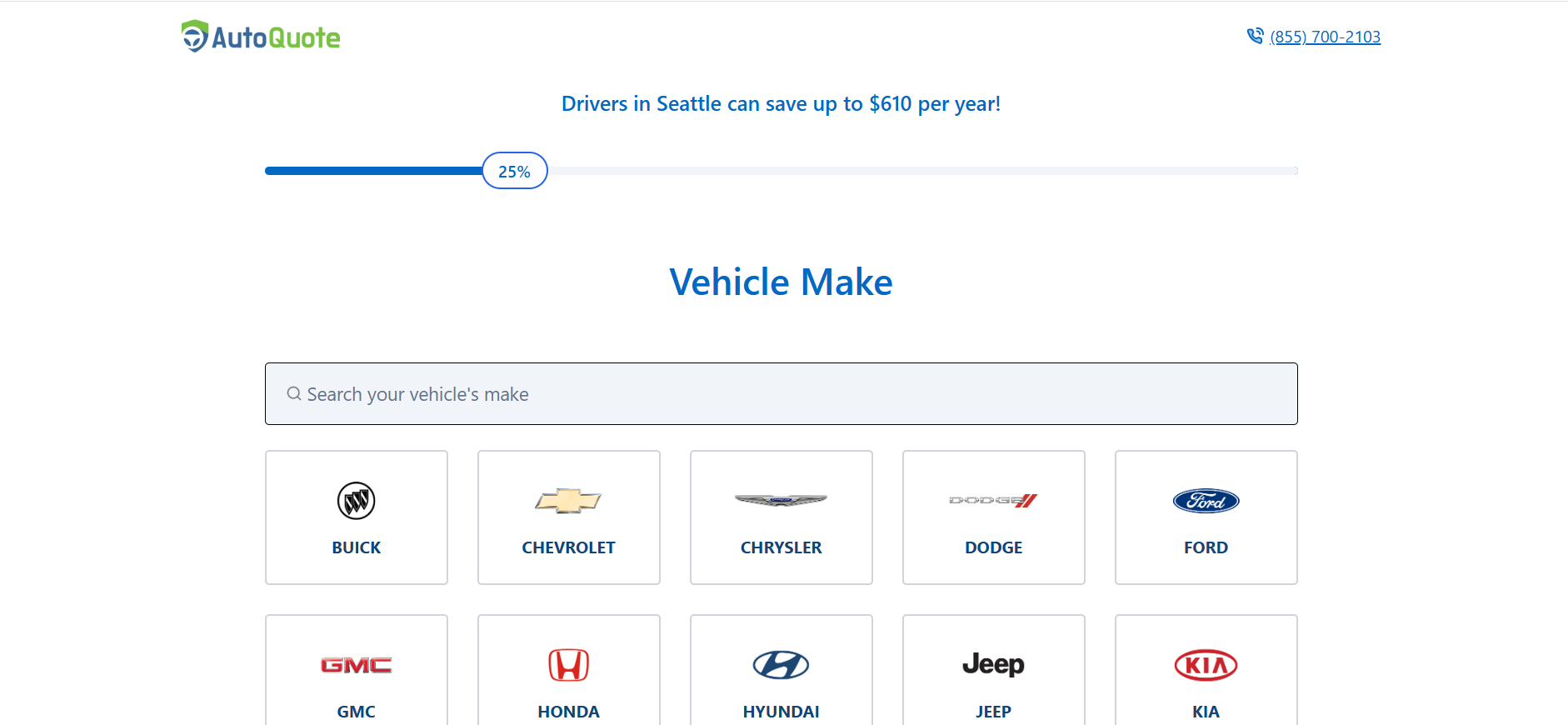

Auto Quote Guide

✅ Multiple Carrier Matches

✅ No-Obligation Options

Ranked #2

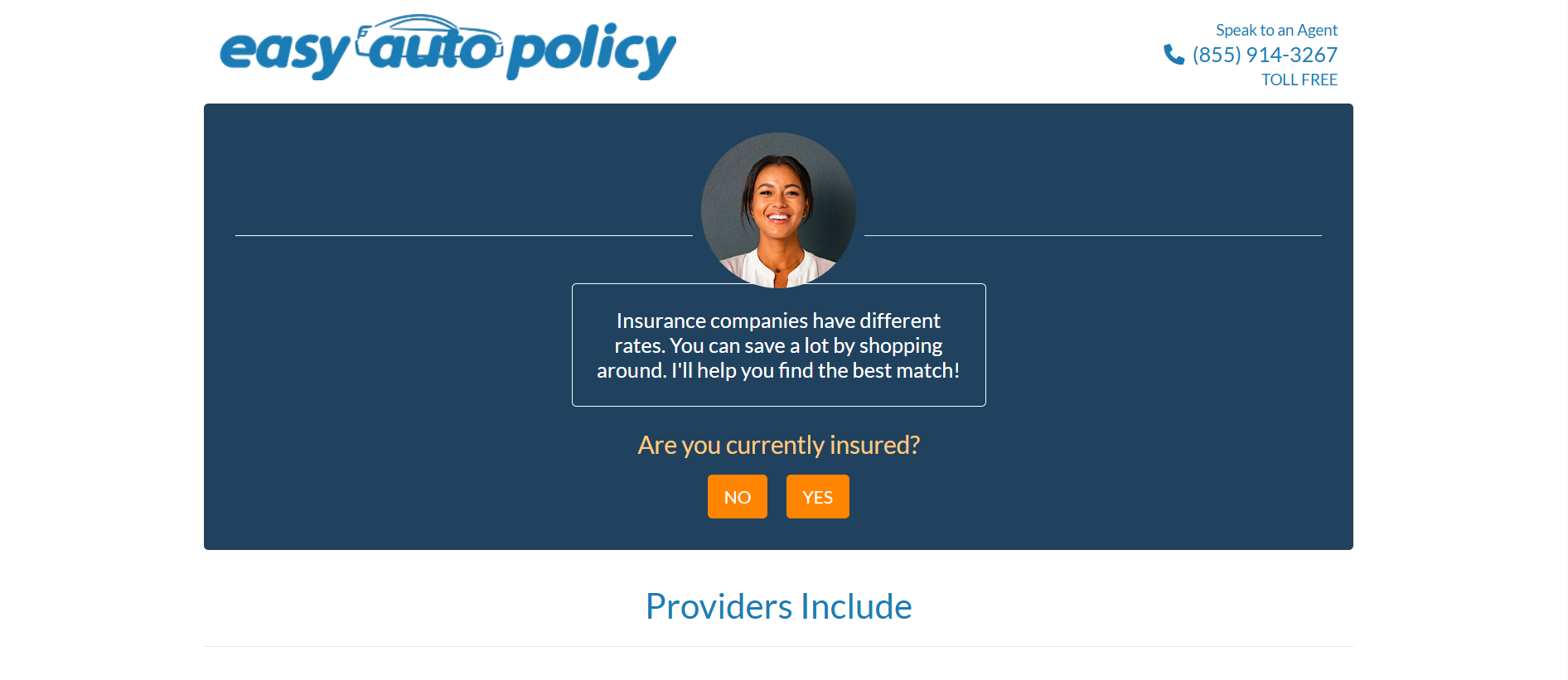

Easy Auto Policy

✅ Competitive Rates

✅ Trusted Carriers

Ranked #3

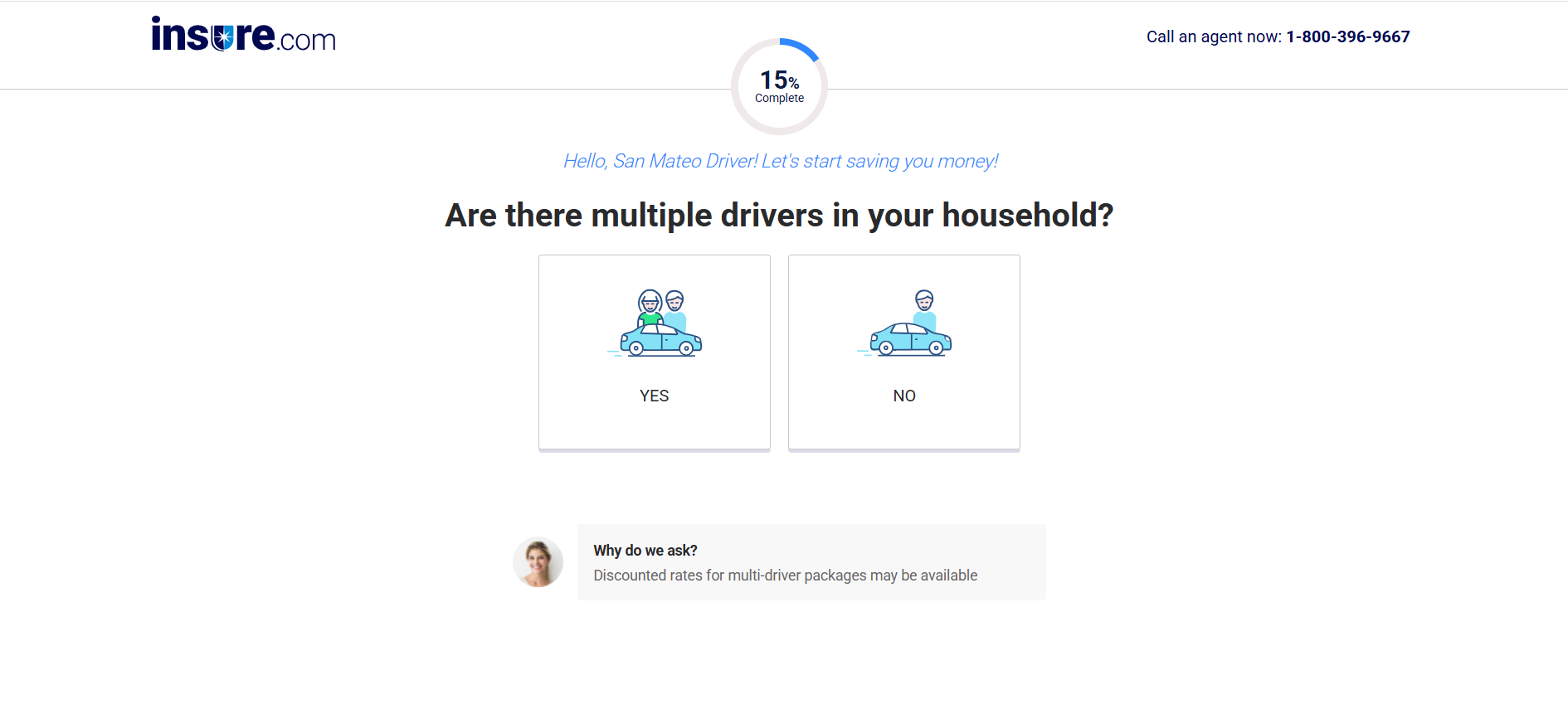

Insure.com

✅ Trusted Auto Insurance Experts

✅ Compare Top Carriers

✅ Quick & Simple Form

Ranked #1

Insure Me Now

✅ Instant Policy Options

✅ Hassle-Free Enrollment

Ranked #5

The Right Car Insurance Matters

Car insurance is a must-have, but choosing the right provider can mean the difference between saving money and getting stuck with a bad policy. Whether you’re looking for affordable rates, top-notch customer service, or the best coverage options, it’s important to compare your options before renewing or switching providers.

Car insurance is evolving, with companies offering more digital tools, AI-driven claims processing, and customized policies. Rates are also changing, with some insurers raising premiums while others are offering new discounts.

A low price isn’t the only thing that matters. Here’s what you should consider when selecting an insurer

Evaluating Car Insurance Quotes

Evaluation Criteria:

- Claims Process: Some companies are faster and easier to deal with when you file a claim.

- Coverage Options: Some policies offer better protection against accidents, theft, or natural disasters.

- Discounts & Savings: The right provider can save you hundreds per year through safe driver, multi-policy, and other discounts.

Top 5 Auto Insurance Companies:

#1 Provide Auto Insurance

Provide Auto makes it easy to compare auto insurance rates from top providers, helping drivers find affordable coverage tailored to their needs. The platform offers a fast, no-obligation quote process, giving users access to multiple insurance options in just minutes. Whether you’re looking for basic liability or full coverage, Provide Auto simplifies the shopping experience with clear comparisons and competitive pricing.

A key advantage of using Provide Auto is the ability to quickly see which insurers offer the best rates based on your unique driving profile. You can also explore potential discounts for things like safe driving, bundling policies, or owning a car with safety features. With its user-friendly interface and commitment to transparency, Quotes Scan is a smart starting point for anyone looking to save on auto insurance without sacrificing quality coverage.

Pros

- Instant Quotes

- Nationwide Providers

- Easy Comparison Tool

Cons

- Higher premiums

- Discounts vary by state

#2 Autoquoteguide.com

AutoQuoteGuide.com simplifies the car insurance shopping experience by connecting drivers with top providers offering competitive rates and customized coverage options. With an easy-to-use online form, users can quickly compare quotes from trusted insurers, helping them find a policy that fits their budget and driving needs. Whether you’re looking for basic liability coverage or comprehensive protection, AutoQuoteGuide.com makes it fast and convenient to explore your options.

In addition to saving time, AutoQuoteGuide.com helps drivers maximize savings by highlighting available discounts and tailoring recommendations based on individual driving habits and vehicle details. The platform is ideal for those who want a hassle-free way to compare policies and secure affordable auto insurance with confidence.

Pros

- Fast Quote Process

- Multiple Carrier Matches

- No-Obligation Options

Cons

- Rates can increase after claims

- Customer service varies

#3 Easy Auto policy

Easy Auto Policy is a convenient option for drivers seeking affordable and customizable car insurance. The platform connects users with top-rated providers, making it easy to compare quotes and find the best coverage for their needs. Whether you’re a first-time driver or looking to switch providers, Easy Auto Policy offers a fast, hassle-free way to explore options and save on premiums.

One of the standout features is the ability to access multiple quotes in minutes, helping drivers make informed decisions without the usual stress. The service also emphasizes flexibility, offering coverage that can be tailored to fit different budgets and driving habits. For anyone who values simplicity, speed, and savings, Easy Auto Policy is a smart place to start your insurance journey.

Pros

- Hassle-Free Application

- Competitive Rates

- Trusted Carriers

Cons

- Limited availability

- Higher rates for high-risk drivers

#4 Insure.com

Insure.com offers a convenient and efficient way to compare auto insurance quotes from top-rated providers, helping drivers find coverage tailored to their needs and budget. Rather than relying on a single insurer, Insure.com connects users with multiple carriers, ensuring a wide range of options and competitive pricing. Whether you’re looking for liability, collision, or comprehensive coverage, Insure.com makes it easy to explore and compare policies in one place.

One of Insure.com’s standout features is its user-friendly quote tool, which simplifies the process of finding affordable auto insurance. With access to discounts for safe driving, bundled policies, and more, users can quickly identify opportunities to save. For drivers who value convenience, transparency, and choice, Insure.com is a smart starting point on the road to better coverage.

Pros

- Trusted Auto Insurance Experts

- Compare Top Carriers

- Quick & Simple Form

Cons

- Fewer digital tools

- Limited nationwide availability

#5 Insuremenow Auto Insurance

InsureMeNow.ai stands out as a smart, user-friendly platform designed to help drivers find affordable auto insurance quickly and easily. Specializing in matching users with competitive rates from top-rated providers, the platform is especially useful for high-risk drivers or those with unique coverage needs. With access to a wide range of standard and customizable coverage options, InsureMeNow.ai makes it easy to compare policies and save money.

Beyond affordability, InsureMeNow.ai focuses on convenience and speed, offering a seamless online experience without the need for lengthy phone calls or paperwork. While it doesn’t underwrite insurance itself, its strength lies in connecting users to insurers who offer solid coverage, discounts for safe driving and bundled policies, and dependable customer service—making it a great option for anyone looking to simplify their search for low-cost auto insurance.

Pros

- AI-Powered Matches

- Instant Policy Options

- Hassle-Free Enrollment

Cons

- Fewer online options

- Slower claims process

Explore Our Categories

Credit Cards

Debt

Loans

Insurance

Retirement

Home Buying

Investing

Taxes

Assistance

Comparing Quotes And Getting The Best Deals

Comparing auto insurance quotes effectively requires more than just looking at the price. Start by evaluating the coverage levels, deductibles, and policy features offered by each insurer. A lower premium may seem attractive, but it could come with higher out-of-pocket costs if an accident occurs. Make sure to compare similar coverage types, including liability, comprehensive, and collision, to get an accurate assessment of value. Additionally, consider add-ons like roadside assistance, accident forgiveness, and rental car reimbursement, as these can impact the overall protection you receive.

To get the best deal, take advantage of discounts and customize your policy to fit your driving habits. Many insurers offer savings for bundling multiple policies, maintaining a clean driving record, or using telematics-based programs that reward safe driving. Request quotes from multiple companies and check reviews to gauge customer satisfaction and claims processing efficiency. Finally, balance affordability with quality service—choosing the cheapest option may not be worthwhile if it lacks reliability when you need it most.